On the demand side of U.S. health care economics, patients are now payors as health consumers with more financial skin in paying medical bills. As consumers, people have great expectations from the organizations on the supply side of health care — providers (hospitals and doctors), health insurance plans, pharma and medical device companies.

On the demand side of U.S. health care economics, patients are now payors as health consumers with more financial skin in paying medical bills. As consumers, people have great expectations from the organizations on the supply side of health care — providers (hospitals and doctors), health insurance plans, pharma and medical device companies.

But as payors, health consumers face challenges in getting care, so great expectations are met with frustration and eroding trust with the system, according to the latest Connected Healthcare Consumer report from Salesforce published today as the company announced expansion of their health cloud capabilities.

This is a global study, conducted among health citizens from North America, Latin America, Europe and the Asia Pacific region. Salesforce conducted interviews with nearly 6,000 people for the report, including 2,002 U.S. adults in July and August 2019.

Some of the key U.S. findings were that,

- 83% of people want health web portals personalized to them

- 55% would value live chat and instant message for medical tasks

- 70% would be interested in accessing a live health coach

- 68% would be interested in a mobile app to enable that health coaching

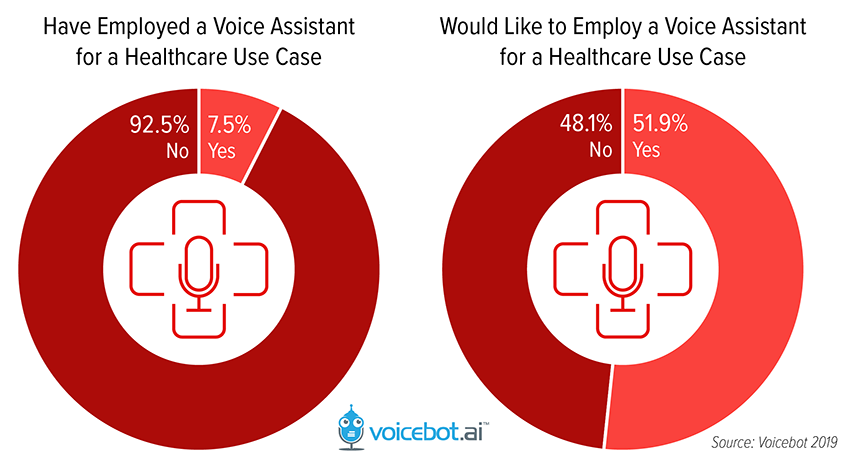

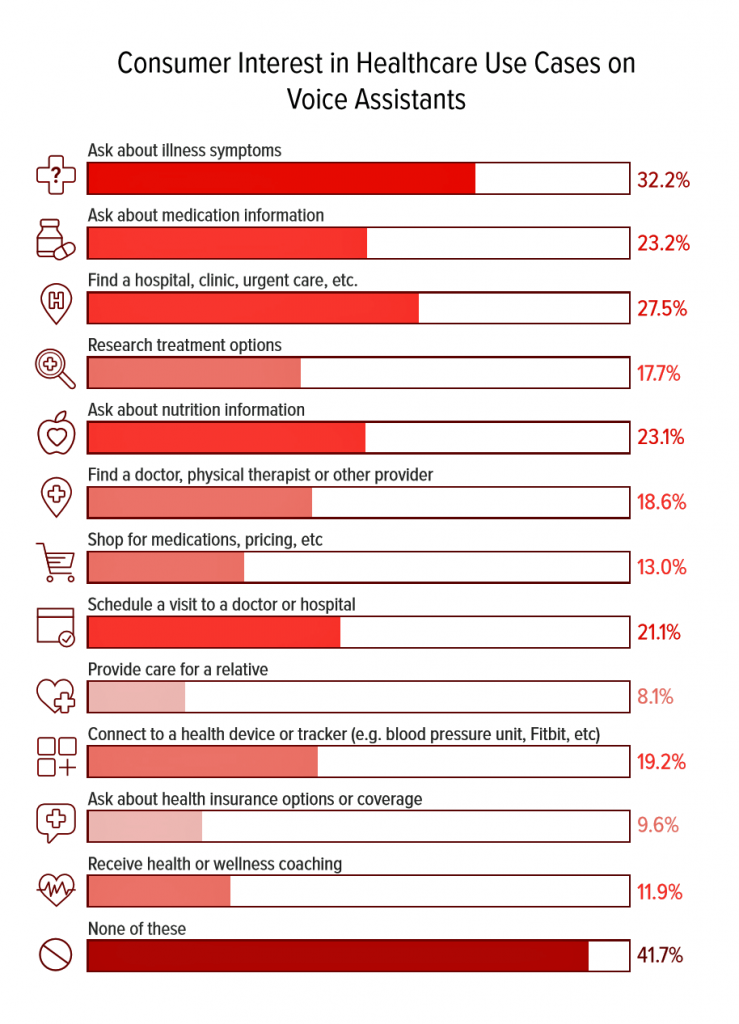

- 53% would be interested in a voice assistant for health care.

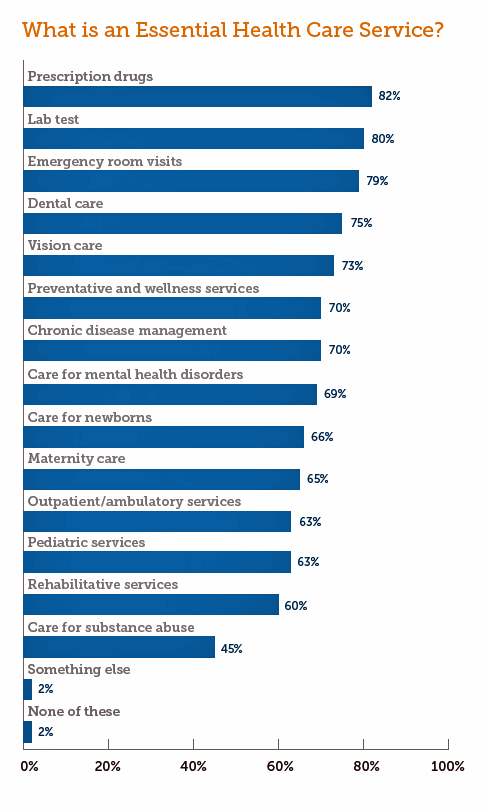

Compare the findings in the first chart above with the second chart here on consumers’ expectations from the healthcare system.

Compare the findings in the first chart above with the second chart here on consumers’ expectations from the healthcare system.

Patients as health consumers face challenges paying for care, managing mental health, finding health services and taking time off work to access them, caregiving, and in transportation for care along with personal mobility issues.

A few key data points illustrate the magnitude of the frustration: 50% of U.S. consumers told Salesforce that life circumstances have caused them to miss a medical appointment; 40% have challenges finding health services nearby; and, 44% of people said taking time off of work to get care is challenging.

Frustration across this continuum of challenges results in the finding that about 1 in 2 people say health care organizations are more focused on the industry/business than on peoples’ needs.

But experience is as important as products for 8 in 10 people.

On that personalization, tactical level, most of the healthcare suppliers don’t provide relevant communications to patients: the top performer here was providers, with 49% of consumers saying hospitals’ and clinicians’ communications were personally relevant. Most patients-as-consumers said it would be important for providers to provide good customer support, know details of “my record” once identified, follow up on progress and outcomes, provide easy access to my health records, send communications relevant to my needs, and proactively communicate with me.

40% of consumers found insurers’ communications to be relevant to “me.” Nearly all consumers look to insurance companies to provide easy-to-understand explanations of benefits, provide details cost and copayment information, easy access to health records, follow up to ensure issues were resolved, make it easy to submit claims, and know my details.

Only 33% of consumers said communications from pharma companies were relevant “to me.” But patients here, too, want pharma to build direct relationships with them, according to Salesforce’s analysis. The majority of patients seek good customer support from pharma, education on how to derive the most value from my medications, advice and resources to ensure medication adherence, relevant offers and rebates, and follow up on progress and outcomes.

Americans cite health care (69 percent) and mass shootings (71 percent) as a significant source of stress.

Health Populi’s Hot Points: The top challenges in patients seeking care noted in the first chart related to paying for treatment, following by mental and emotional well-being.

This third chart comes from the latest annual Stress in America survey done by the American Psychological Association, published today on U.S. Election Day 2019.

Note the sobering symmetric findings that 7 in 10 Americans report that both mass shootings and health care are “significant sources of stress.”

The cost of health care was the most commonly cited source of health care stress (among 64%).

“There is a lot of uncertainty in our world right now — from mass shootings to climate change…more Americans are saying these issues are causing them stress,” APA’s CEO Arthur C. Evans Jr., said in the study’s press release. “Over time, prolonged feelings of anxiety and stress can affect our overall physical and mental health.”

The survey was conducted by The Harris Poll for the APA in August and September 2019 among 3,617 U.S. adults.

The health care industry can do a better job supporting patients-as-health-consumers when it comes to managing the stress of the cost of health care, the Salesforce research suggests. This last bar chart provides some granular recommendations for healthcare industry suppliers, whether providers or pharma companies or health plans, to extend tools and information on cost, access, self-care and risk management that’s personally relevant and clear.

The health care industry can do a better job supporting patients-as-health-consumers when it comes to managing the stress of the cost of health care, the Salesforce research suggests. This last bar chart provides some granular recommendations for healthcare industry suppliers, whether providers or pharma companies or health plans, to extend tools and information on cost, access, self-care and risk management that’s personally relevant and clear.

At least eight in ten consumers would like to see better communication across all of these cost-access-advice issues.

That is for the immediate-near term under the fragmented, high-cost health care system that currently challenge American health citizens.

Today as Election Day, I recall my post published yesterday here in Health Populi on U.S. voters’ perspectives on health care reform looking toward Election Day 2020. With health care reform a top issue driving people to polls in the 2018 mid-term elections, I am certain the issue will continue to light fires under millions of patients’ political activism over the next 364 days.

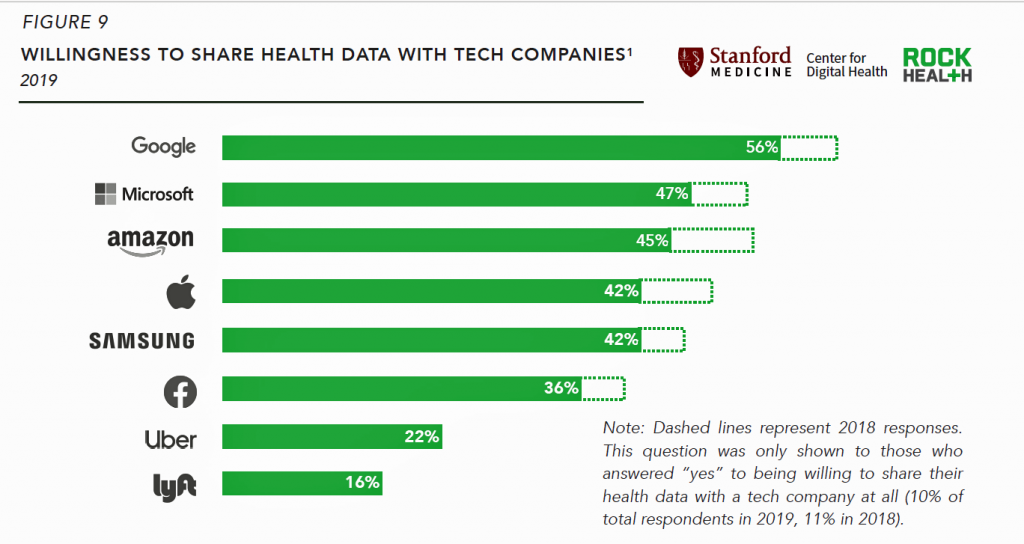

In the meantime, more understandable EOBs, streamlined patient access programs for innovative drugs and devices, Uber and Lyft rides to medical appointments, food pharmacies and greater self-care through switched over-the-counter medicines must help people muddle through their individual health consumer journeys.

The post Great Expectations for Health Care: Patients Look for Consumer Experience and Trust in Salesforce’s Latest Research appeared first on HealthPopuli.com.

Great Expectations for Health Care: Patients Look for Consumer Experience and Trust in Salesforce’s Latest Research posted first on http://drugsscreeningpage.blogspot.com/

On the demand side of U.S. health care economics, patients are now payors as health consumers with more financial skin in paying medical bills. As consumers, people have great expectations from the organizations on the supply side of health care — providers (hospitals and doctors), health insurance plans, pharma and medical device companies.

On the demand side of U.S. health care economics, patients are now payors as health consumers with more financial skin in paying medical bills. As consumers, people have great expectations from the organizations on the supply side of health care — providers (hospitals and doctors), health insurance plans, pharma and medical device companies. Compare the findings in the first chart above with the second chart here on consumers’ expectations from the healthcare system.

Compare the findings in the first chart above with the second chart here on consumers’ expectations from the healthcare system.

The health care industry can do a better job supporting patients-as-health-consumers when it comes to managing the stress of the cost of health care, the Salesforce research suggests. This last bar chart provides some granular recommendations for healthcare industry suppliers, whether providers or pharma companies or health plans, to extend tools and information on cost, access, self-care and risk management that’s personally relevant and clear.

The health care industry can do a better job supporting patients-as-health-consumers when it comes to managing the stress of the cost of health care, the Salesforce research suggests. This last bar chart provides some granular recommendations for healthcare industry suppliers, whether providers or pharma companies or health plans, to extend tools and information on cost, access, self-care and risk management that’s personally relevant and clear.

While 75 million people in the U.S. have a smart people at home, only 1 in 13 Americans have used a voice assistant like Alexa or Google Assistant for health care.

While 75 million people in the U.S. have a smart people at home, only 1 in 13 Americans have used a voice assistant like Alexa or Google Assistant for health care.

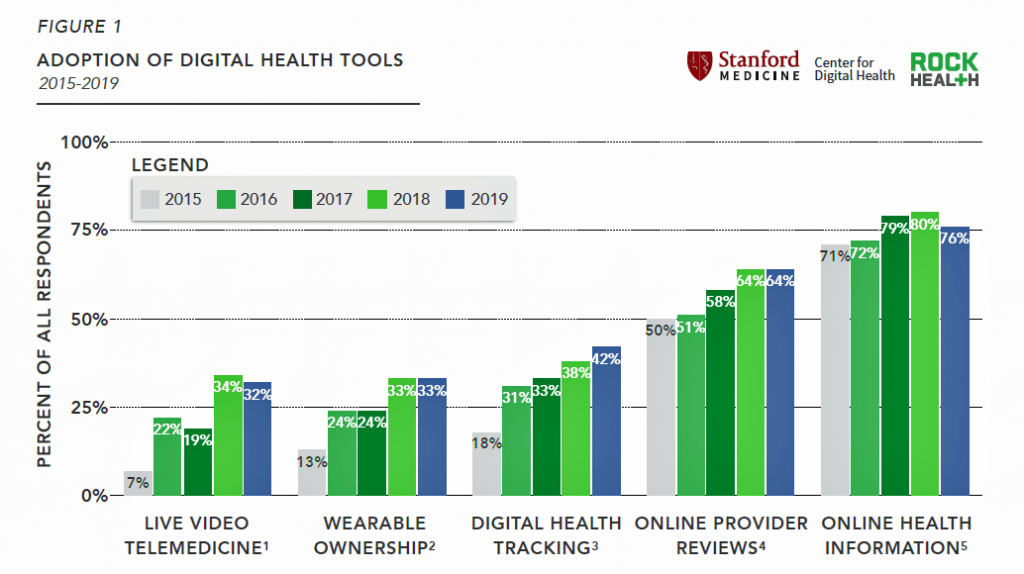

Patients searching online for health information and health care provider reviews is mainstream in 2019. Digital health tracking is now adopted by 4 in 10 U.S. consumers.

Patients searching online for health information and health care provider reviews is mainstream in 2019. Digital health tracking is now adopted by 4 in 10 U.S. consumers.

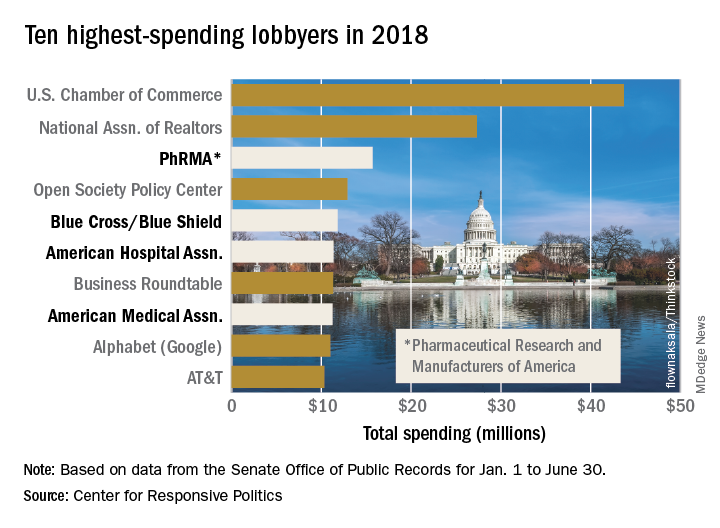

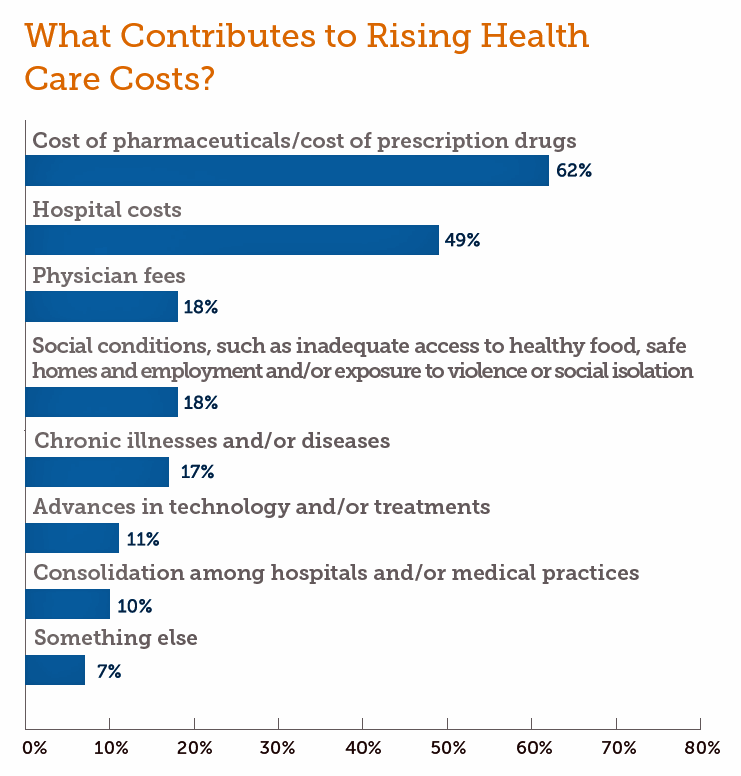

Top of mind for Americans in 2019 is the price of prescription drugs, according to 62% of people. Hospital costs contribute to rising medical costs to 49% of health consumers. Physician fees are cited as cost-contributing by only 18% of patients.

Top of mind for Americans in 2019 is the price of prescription drugs, according to 62% of people. Hospital costs contribute to rising medical costs to 49% of health consumers. Physician fees are cited as cost-contributing by only 18% of patients.